Itemizing Medical Expenses 2024. Updated on february 5, 2024. For 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted gross income.

Are medical expenses tax deductible in 2023? To accomplish this, your deductions must be from a list approved by the.

Yes, Medical Expenses Are Still Tax Deductible In 2023.

99 medical expenses you can deduct in 2024.

State And Local Taxes, Charitable Donations, And Home.

$3,700 if you are single or filing as head of household.

The 7.5% Threshold Used To Be 10%,.

Images References :

Source: savingtalents.com

Source: savingtalents.com

How to Itemize Your Medical Expenses on Your Taxes Saving Talents, To accomplish this, your deductions must be from a list approved by the. $3,000 per qualifying individual if you are.

Source: savingtalents.com

Source: savingtalents.com

How to Itemize Your Medical Expenses on Your Taxes Saving Talents, To accomplish this, your deductions must be from a list approved by the. Published on march 25, 2024.

Source: savingtalents.com

Source: savingtalents.com

How to Itemize Your Medical Expenses on Your Taxes Saving Talents, To do that, most clients must itemize their deductions. Here are 11 of them.

Source: savingtalents.com

Source: savingtalents.com

How to Itemize Your Medical Expenses on Your Taxes Saving Talents, If you itemize your deductions for a taxable year on schedule a (form 1040), itemized deductions, you may be able to deduct the medical and dental expenses you paid for yourself, your spouse, and your dependents during the taxable year to the. For the 2024 tax year, the irs allows individuals to deduct a portion of their premiums as medical expenses.

Source: templates.rjuuc.edu.np

Source: templates.rjuuc.edu.np

Itemized Medical Bill Template, You can deduct the cost of medical. Yes, medical expenses are still tax deductible in 2023.

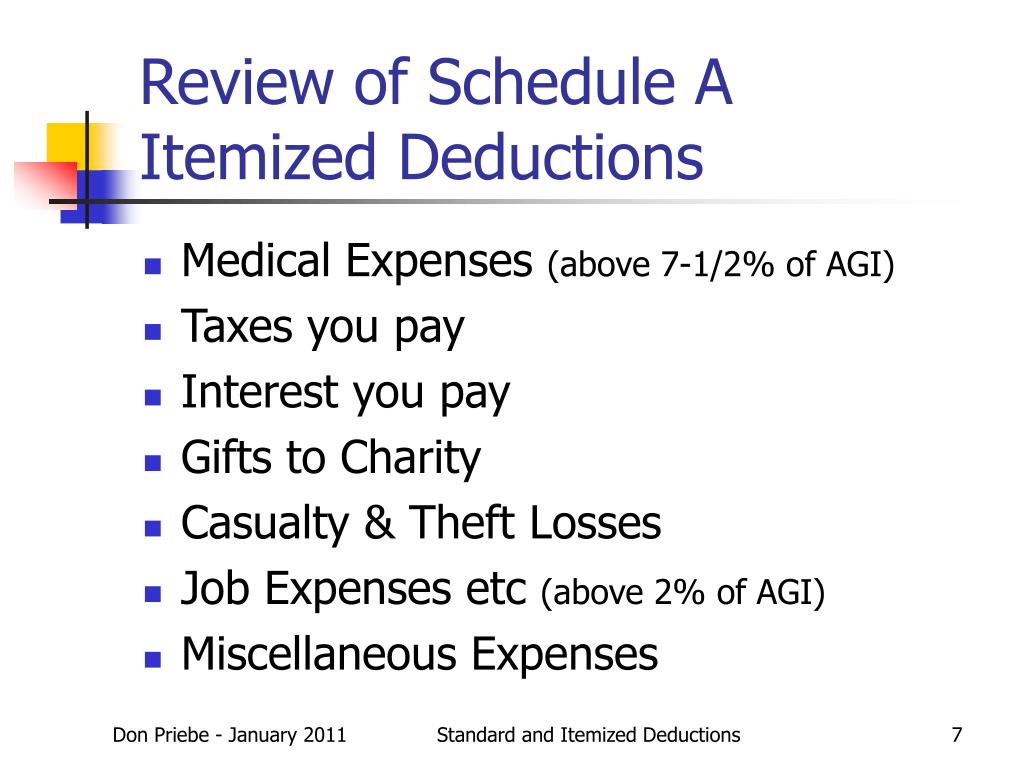

Source: www.slideserve.com

Source: www.slideserve.com

PPT Standard and Itemized Deductions PowerPoint Presentation, free, If you are 65 or older and blind, the extra standard deduction is: Itemized deductions are an alternative to the standard tax deduction and can help you reduce your total federal income tax bill.

Source: savingtalents.com

Source: savingtalents.com

How to Itemize Your Medical Expenses on Your Taxes Saving Talents, If you itemize your deductions for a taxable year on schedule a (form 1040), itemized deductions, you may be able to deduct the medical and dental expenses you paid for yourself, your spouse, and your dependents during the taxable year to the. No, you can only deduct medical expenses that have not been reimbursed by insurance or.

Source: www.cbmcpa.com

Source: www.cbmcpa.com

Rx for Itemizing Medical Expenses Councilor, Buchanan & Mitchell (CBM), Medical and dental expenses that exceed 7.5% of your agi. You can deduct the cost of medical.

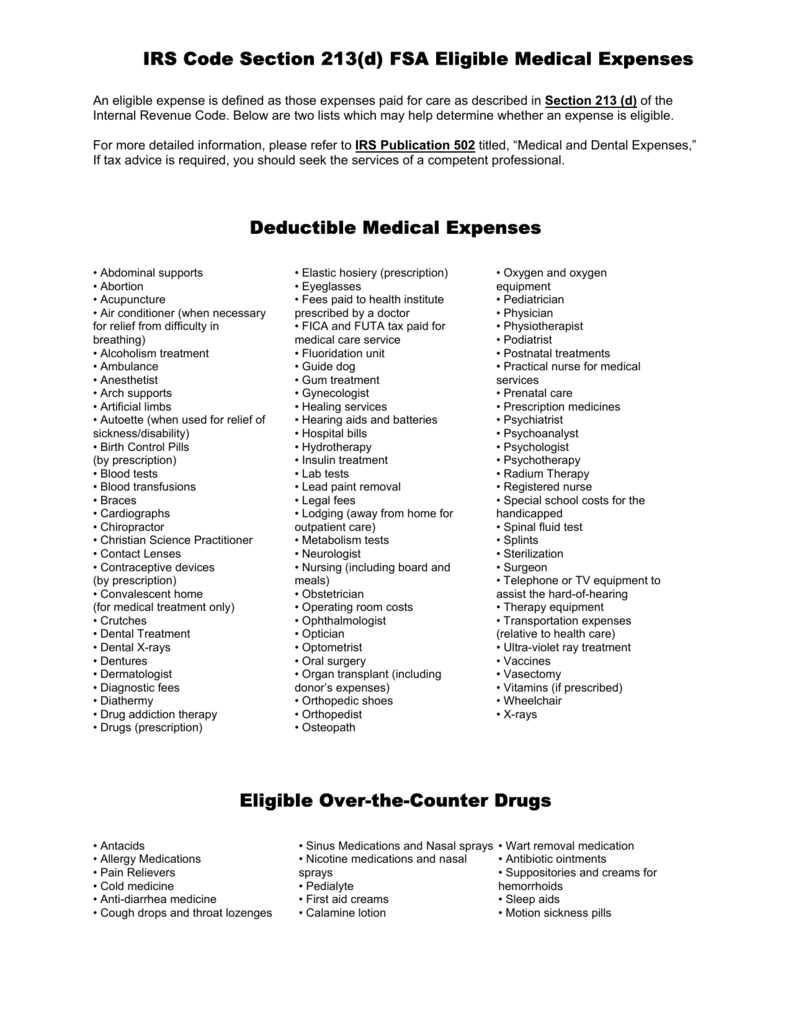

Source: studylib.net

Source: studylib.net

IRS Code Section 213(d) FSA Eligible Medical Expenses Deductible, To do that, most clients must itemize their deductions. You can deduct certain unreimbursed medical expenses that exceed 7.5% of your adjusted gross income if you itemize.

Source: www.pinterest.com

Source: www.pinterest.com

How to Itemize Your Medical Expenses on Your Taxes in 2023 Tax, You're only allowed to deduct medical expenses that exceed. Updated on january 8, 2024.

The 7.5% Threshold Used To Be 10%,.

What’s the threshold for itemizing medical expenses?

For The 2024 Tax Year, The Irs Allows Individuals To Deduct A Portion Of Their Premiums As Medical Expenses.

As you can read above, the standard deduction for single taxpayers and married individuals filing separately has increased from $6,350 in 2017 to $14,600 in 2024.